This 'n' That; The Trump Tax Plan; October 1st

Trump Tax Plan~Some Things I Like, Some I Don't

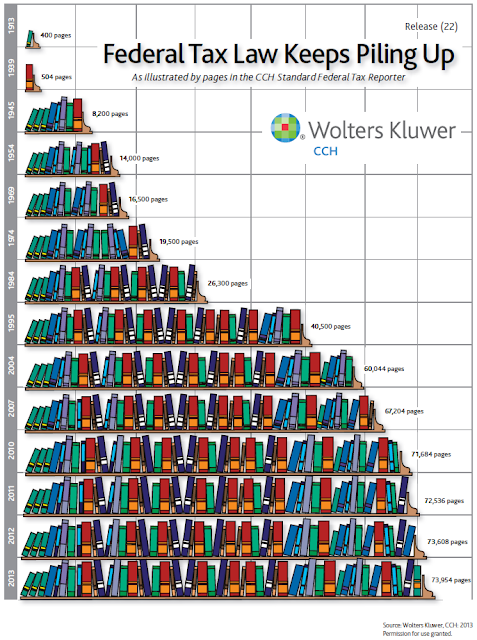

Given the current size of the IRS Tax Code, it's no wonder that Donald Trump only hit the high points.

He failed to mention an important one, but let's get to that later.

Mr Trump's tax plan points will be in 'Georgia-italic' and my comments will be in 'Trebuchet.' Buckle up and let's get after it. Mr Trump's tax plan:

- Reduces tax brackets from 7 to 4: 0%, 10%, 20%, 25%.

- I'm really not in favor of multi- bracket system. Look at all the taxes the average American pays BEYOND the income tax: fuel taxes, city-county-state sales taxes, excise taxes on such things as auto tires and appliances, Medicare Tax [even for me at 69 years old~having no use for it and probably never will~BUT still gotta pay the premiums.] Given all these ancillary taxes.... how 'bout we average Mr Trump's four brackets for a FLAT TAX rate of 6.25%. This should apply to "every dam' dime" that changes hands whether earned income, interest, dividends, welfareRAT cash payments, welfareRAT in-kind benefits, EVERY DAM' DIME!!

- Singles up to $25,000; Couples up to $50,000 pay no tax.

- a] If "Johnny" earns $24,500; If "Sam 'n' Jane" together earn $49,950... where's the incentive to accept a merit raise or taking a promotion that involves a bump in pay. In each case those involved may go from paying no tax at all to pay some tax which very well might eclipse any increase in pay.

- b] Everyone~even the most downtrodden amongst us, the welfareRATs~MUST have "skin-in-the-game." To that end, there must be a minimum tax liability~based on dollars, not percentages~such as $100.00. Everyone must experience that which almost half of the adult population does annually--PAY TAXES!

- Eliminates marriage penalty, AMT, estate tax.

- I have no problem with these. Each in it's own way is a penalty on achievement, even more than that of merely paying confiscatory income taxes.

- Any business of any size, no more than 15% income tax.

- The greatly reduced corporate tax rate has been suggested from time to time by those not too worried about remaining in the 'ruling class.' The United States' current maximum corporate income tax is 38%, likely the highest rate on the planet! ANY rate reduction will reduce the penalty on success.

- Ends most deductions and loopholes; ends tax treatment for 'carried interest.'

- There's so-o-o-o many loopholes out there, the average taxpayer has no idea. I'm not well-versed enough to speak on these except to say that all of them should be eliminated.

- One-time repatriation of corporate cash at special 10% tax rate.

- Excellent idea!

- End of deferred taxes on corporate earnings generated overseas.

- Good idea.

- A phased-in cap on business expense deductions.

- I think this category needs a bit of clarification. Businesses come in all sizes, shapes and valuations. There should be some limits in write-offs, but not a straight-line cap. Put limits on those... say over $50 million valuation~primarily the GEs of the country~but allow "Joe's Cabinet Shop 'n' Taco Stand, Inc" to deduct a far larger percentage of it's expenses.

- Leaves in place deductions for charitable giving and mortgage interest.

- I got'a couple'a problems with this category:

- a] {Tighten Requirements} Anybody and his brother can apply for and receive a charity designation~unless, of course, you use conservative, "Tea Party" words in your title. Take the "Bill, Hillary and Chelsea Clinton Crime Family Foundation" for instance: They use any number of crooked methods~Hillary's emails,pay-to-play schemes~in fundraising while spending comparatively little in the way of charity. Believe it or not, that's but one of the quasi-crooked charities out there! The requirements to be a recognized charity have to be tightened up; limits should be put on charities' cash-on-hand, i.e., in their fiscal year, they should have to spend 75% of donations, interest earnings [on good stuff NOT private-plane rides].

- b] {Eliminate} Way back when~say pre-1930~the vast, vast majority of mortgages were for farms and other agricultural endeavors. Mortgages for private housing didn't come about on a large scale until the 1950s-60s. Since then the mortgage deduction was used as "a stimulus" to prop up the realty and house-building industries. In today's world, said deduction really doesn't amount to crap when compared to the annual payments or when compared to the total value of the house.

Now we come to the "buckle up" part.... the Earned Income Tax Credit.

I've been fortunate in most phases of my life in that I've never qualified for the EIC. Maybe that's why I'm so against it. I've been on the edge of poverty while in the military and supporting three little kids. Ya know what I did? I went out and got'a dam part-time job!! Here's a blurb on the origins of the EIC:

"The earned income credit was originally enacted in 1975, and over the years it has grown to be one of the principal antipoverty programs in the federal budget. The credit was expanded significantly by the Omnibus Budget Reconciliation Act of 1993, and in 1998 some 18 million taxpayers were expected to claim more than $27 billion of earned income tax credits, with an average credit per taxpayer of almost $1,480 per year (U.S. Congress 1996: 809). In 1998, some families will be entitled to claim an earned income tax credit of up to $3,756 per year."

When Mr Trump becomes "the Leader of McNamara's Band" [president], he most assuredly must look into the EIC. At the very least, the EIC must be structured such that it ONLY REDUCES THE TAX LIABILITY TO ZERO! Absolutely no one should 'profit' from the EIC, i.e., getting more back than they paid in!!

That's all I got.

Til Nex'Time....

Justin Case

Reference "Lie-Barry:"

[Business/personal income tax rates] http://www.smbiz.com/sbrl001.html

Comments

Post a Comment